Budget Frequently Asked Questions

-

Below are answers from frequently asked questions about Keller ISD's budgeting process and Texas public school finance.

-

How much of a deficit is KISD facing for the 2024-25 school year?

For the next school year, we are facing a budget deficit of more than $27 million if nothing changes. This number will fluctuate slightly with inflation, enrollment, attendance, legislative action, and measures the District takes to find savings.

-

How is Keller ISD funded?

School districts in Texas are funded primarily by a combination of local property taxes and state revenue. The state has established a funding formula that determines how much a school district is entitled to, based on a number of factors like average daily attendance and needs of the students. First, revenue collected from property taxes is used to meet a district’s funding entitlement – the amount of funding the state has determined each school district should receive. If a district is unable to generate all of its funding via local property taxes, the state will provide additional funding. If a district generates more than its funding entitlement due to high local property tax collection, the excess revenue will be kept by the state for redistribution to other districts. This is known as Recapture. (Source) Districts also receive a small portion of funding from the federal government.

-

Why is KISD facing a budget crisis?

There are a number of factors affecting our budget that are outside of our control:

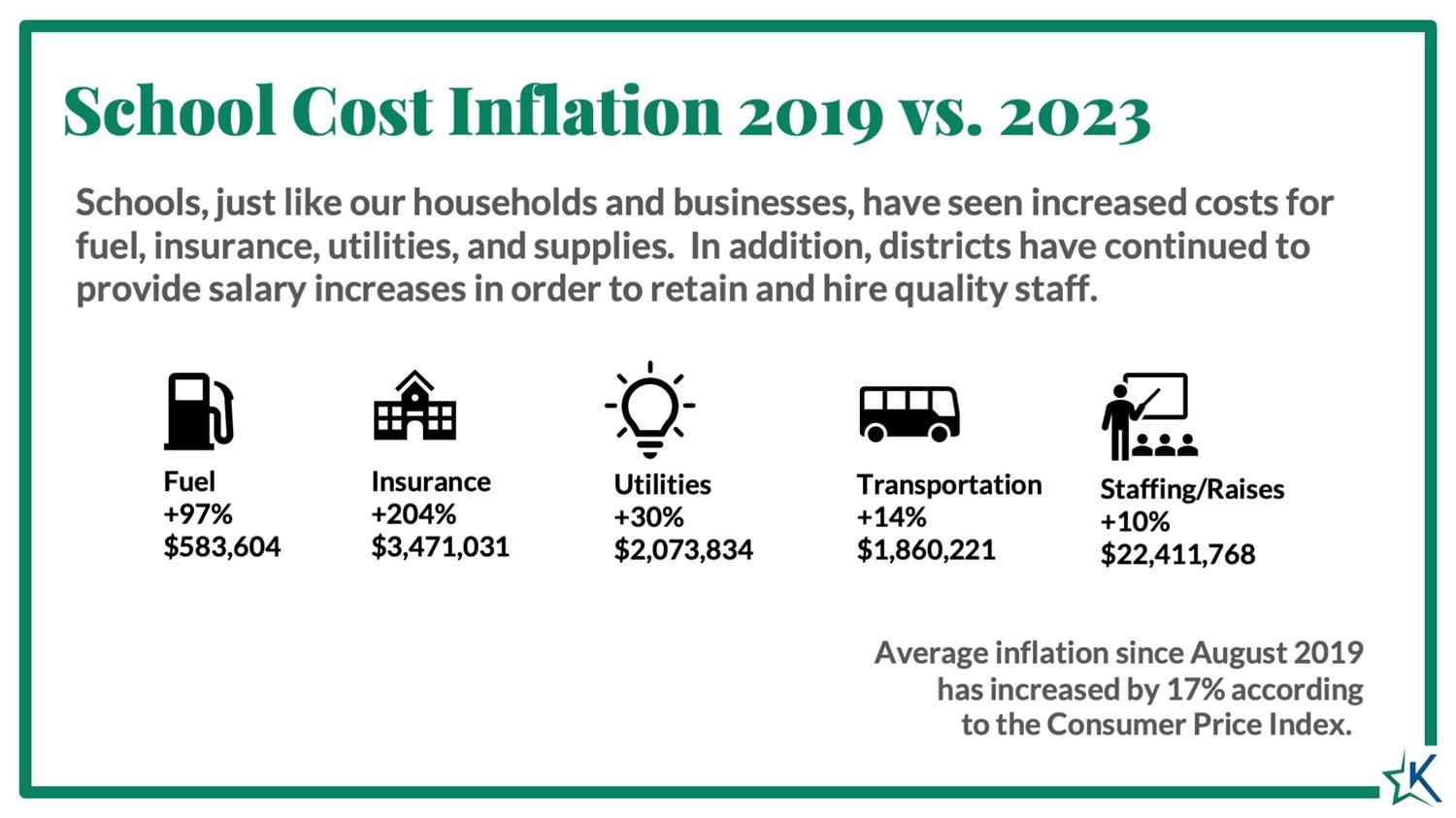

- An outdated state funding formula that has not been changed since 2019, despite record inflation which has increased the cost of everything from from fuel, to insurance, to supplies.

- Underfunded mandates from the state: the state requires that we provide things like special education programs, safety measures, teacher raises, and technology for our students, but does not provide the funding for us to do so. We have little flexibility in these areas, and if the state fully funded those programs they mandate, our budget deficit would be resolved.

- School funding based on average daily attendance vs enrollment. Texas is one of only six states which funds public K-12 schools based on actual student attendance rather than enrollment. We must plan for educating the number of students enrolled, but we only receive funding based on average daily attendance.

Bottom line, the cost of educating our students has increased significantly, while funding has remained stagnant. We need the State of Texas to use their record surplus to fully fund our schools.

-

How have flattened enrollment and attendance over the recent years impacted the budget?

Student growth has indeed flattened over the last decade, especially post-COVID, not only in Keller ISD, but across the State of Texas and even the country. This slowed student population growth does represent a significant part of the challenge. Population shifts and other factors out of our control affect enrollment. Currently, the state provides a basic allotment of $6,160 in per-pupil funding. When enrollment slows, KISD receives less funding, yet still has to keep school operations running (buses, teacher pay, maintenance, operations, etc).

Additionally, Texas is one of only six states that fund schools based on Average Daily Attendance (ADA) vs. Enrollment. In other words, funding is based on how many students are actually in the classroom each day, not how many students are enrolled in the District. So, while we’re expected to prepare for 100% of students attending on a given day, we’re only given funding for 94-96% in any given year, depending on attendance figures. Were our funding based on enrollment instead of attendance, the District would have approximately $15 million in additional revenue for the 2024-25 school year, and our current budget conversations would be significantly different.

We are doing everything we can to mitigate this challenge with scheduling efficiencies and updated policies like requiring students to remain on campus even if they are exempted from testing. We are also advocating for the state to move to enrollment-based funding, which would help provide consistency with budgeting.

-

If we know that the funding per student will never be 100%, it appears to be mid 90% regularly, why do we budget at 100%?

Our budget is based on only receiving a percentage of our funding. For the 2024-25 budget year, we are projecting 94% attendance and using that level of funding as the starting point for our budget conversations. When we say that we “have to budget for 100%” attendance, it means we have to spend money – on staffing, resources, supplies, etc. – as if every student will be present on any given day.

Public schools are required to provide an education for every student that walks in the door. If you look at it from a classroom perspective, a third-grade classroom may be capped at 24 students. If every day that classroom has 94% attendance, there will only be about 22 students in the classroom at any given time. However, that’s not how things work in reality. Some days all 24 students will be there. Some days the flu may be going through the grade level and only 14 students are there. And while employees are our biggest expense, it’s not just teachers that are needed for every student. We also need desks and other furniture, electronic devices, books or other media for each student.

So, while we’re expected to prepare for 100% of students attending on a given day, we’re only given funding for 94-96% in any given year, depending on attendance figures. Were our funding based on enrollment instead of attendance, the District would have approximately $15 million in additional revenue for the 2024-25 school year, and our current budget conversations would be significantly different.

-

Can you explain the basic allotment and how the state funding formula works?

The basic allotment is the base amount that the state gives our school district per pupil, per year, based on average daily attendance. It is derived from a complex formula made up of many factors. Here is a simplified version of it:

$6,160 (Basic Allotment) x ADA + [SPED x(1.10-1.15)]

+ [DYS x .1] + [CEA x (.225 - .275)] + [(BEA/DL) x (.05-.15)]

+ [SSA x (9.72 x ADA)] + [GTA x (.07 x ADA)] + [CTE x (1.1 -1.47)]

+ [(PEGA + EEA) x .10] + [CCMR x ($2,000 -$5,000)]

+ [FGA x (.15 -.45)] + [TIA x ($3,000 - $12,000)]

+ [MPA x $1,800qt] + [TA x $1.00 reg mile]

+ [NIFA x $1,000 x ADA] + [DRRPFA x $275 x ADA]

+ [TA x (varies)]This formula pays for a district’s operations, supplies, and teacher and staff salaries. However, school districts will never actualize the full amount of the basic allotment due to funding based on average daily attendance. Because we will never have 100% attendance every day of the school year, we will never receive full funding; however, we do have to staff our schools based on 100% attendance.

-

What are "unfunded mandates" from the state, and how are they exasperating financial challenges?

We refer to programs and services that the state requires districts to administer without providing the funding to do so as "underfunded mandates." This in no way suggests that these are not important items, but communicates the reality of the strain they represent on our budget.

These include things like:

Special education

HB 3 (2019): Full-Day Pre-K, Teacher Compensation, Reading Academies, Counseling, CCMR

Technology required for state-mandated testing

Safety requirements

Dyslexia program

Gifted & Talented

If the state would fully fund these "underfunded mandates," our budget deficit would be resolved.

-

What is “Recapture” and how does it affect KISD?

Recapture, also known as “Robin Hood," was created with good intentions – to ensure all students are equitably funded in the state of Texas. Unfortunately, many of the districts whose property taxes have been taken through recapture for redistribution are now facing budget deficits. KISD pays more than $2 million per year to Recapture. This is another strain on our budget which we believe the state should remedy. The state now has a surplus of over $2 billion dollars in excess Recapture funds, with no accountability for how those funds are being managed. Keller ISD’s Board of Trustees passed a resolution in 2023 to ask for transparency on how those funds are spent, but has not received an answer from the state.

-

What has the District done already to ease these challenges in the 2023-2024 budget?

We have taken a number of efficiency measures, including:

- Cuts at our administrative offices totaling almost $4 million

- Staffing efficiencies to offset declining enrollment totaling $4.5 million

- Eliminating vacant positions, saving $3 million

- Withholding 10% of department budgets for this school year, saving over $6 million

These savings helped us find a savings of approximately $17 million and balance the budget in the current school year.

-

Why don’t you just cut administrative positions? The central office is bloated with overpaid staff.

The salaries of the entire central office staff amount to only 1.5% of our overall budget, and even eliminating all positions with central administration would not get us close to fixing our current budget challenges. We have already reduced costs at our central offices by almost $4 million in the most efficient and responsible ways possible in those offices (representing 17.3% of cuts for 2023-24), and plan to reduce costs there by another $ million the next school year (representing 15% of cuts for 2024-25). However, our administrators serve important roles in assisting our teachers and campuses. Balancing these impacts is something we are focused on daily.

-

What is the district’s fund balance and how is it used?

A fund balance is typically thought of as a savings account or a “rainy day fund,” and that would be somewhat accurate. However, it’s also the pool of money that assists with cash flow throughout the school year. School districts don’t receive consistent funding payments from the state over the course of the year, so a healthy fund balance is necessary to ensure that the District can continue to make payroll and pay its bills. With a lack of action from the state, KISD and other area school districts have resorted to using these funds to supplement their general funds to cover everyday expenses like teacher payroll. However, this is not a long-term solution. You can only access those funds for so long before you begin to endanger the operations of the district.

-

Which one-time solutions have already been utilized, and how did they work?

- Keller ISD has previously dipped into our fund balance (or “rainy day fund”) to cover costs;

- We have created efficiencies in the budget, which have saved the District over $17 million already in the current school year (2023-24);

- We are considering the value of selling surplus property owned by KISD.

-

What ways can funding be increased?

School funding can only be increased in a few ways:

- The state can increase funding through legislation. (This is why we advocate for our legislature to fully fund education and provide for the underfunded mandates that have been required. Thank you to all of you who have submitted emails through SaveKellerISD.net.)

- An increase in attendance or enrollment. More students = more funding. However, with more students come additional costs for the district.

- One-time solutions like those articulated above.

- Raising taxes through a voter approved election, though a tax increase would only raise $7 million, while $1 million would go back to the state through Recapture and the state funding formula. Additionally, KISD taxpayers have already seen their tax bills increase over the past four years due to rising property values, with those additional funds going to the state rather than increasing the revenue of Keller ISD.

-

Why do you blame the state for KISD's current budget issues?

The state legislature has put itself in charge of determining the amount of funding for Texas public schools. Simply put, they are the only entity with the power to increase funding for public K-12 schools. The last time they did so was in 2019, leaving our current funding formula sorely outdated in light of record inflation. Further, Texas ranks in the bottom 10 states in the nation in per-pupil funding.

During this two-year budget cycle, the state had a record surplus totaling approximately $50 billion dollars (approximately $40 billion of which still remains unallocated), some of which should be used to fully fund our schools. It’s time for our legislature to step up and appropriately fund our public schools, where we are teaching and training our future leaders here in Texas.

You can help by visiting SaveKellerISD.net and sending a quick email to our representatives, asking them to fully fund public education in Texas.

-

What is the state surplus? What does it really mean?

The State of Texas sometimes enjoys a budget surplus. For this 2-year budget cycle, the state has a record surplus of approximately $50 billion - these are excess funds in the budget. We will continue reaching out to our representatives to insist that they use a substantial amount of this surplus to adequately fund our schools. You can help do the same at SaveKellerISD.net.

-

What is the current district property tax rate?

Our current tax rate, which we lowered earlier this school year, is 1.0875 per $100 of appraised value. Of that, 0.7575 goes to Maintenance and Operations (M&O), while .33 goes to Interest & Sinking (I&S).

-

What is the difference between Maintenance and Operations (M&O) and Interest & Sinking (I&S)?

The M&O tax rate provides funds for maintenance and operations (daily operations of the District) including employee salaries, electricity, utilities, etc. The I&S tax rate provides funds for payments on the debt that finances a district's facilities (payments on voter-approved bond debt for capital expenditures).

-

What are “golden pennies,” and how do they affect funding?

References to "pennies” in Texas public school funding are a way of representing different levels of funds a district can claim in order to receive more funding from the state. House Bill 3 passed by the Legislature in 2019 allows districts up to eight “golden pennies'’ on their maintenance and operations (M&O) tax rate which are not subject to recapture. Keller ISD currently claims all of those.

There are also nine “copper pennies” available, though these funds are subject to recapture – meaning a significant portion of those funds would be sent to the state bureaucracy to be sent to other districts, and KISD would still not see our full increase in funding. It means our community would pay more in taxes, yet lose even more funding to the state.

Claiming these additional pennies would require the community to vote to approve raising taxes.

-

I paid too much taxes and you guys are not paying enough money to the teachers.

Increases in local property taxes are a result of increasing home values, as assessed by the Tarrant Appraisal District. Keller ISD’s property tax rate has decreased from 1.54 to 1.0875 over the past eight years. As explained in the seminar, despite homeowners paying more in property taxes due to increasing home values, school districts have not realized an increase in funding. The more funding generated by local property taxes, the less funding the state provides. Keller ISD knows that providing competitive employee compensation is vital to attracting and retaining highly qualified educators, and we believe that state funding should be increased to provide for additional teacher pay.

-

Why doesn’t KISD just raise taxes?

Increasing local property taxes does not result in significantly increased funding for local school districts. In fact, if KISD raised taxes, we would see more of our local property tax dollars going back to the state for redistribution under Recapture.

Because the State of Texas is working towards lowering property taxes for Texans year after year, the state has increased the amount it contributes to public education while lowering the amount provided by local property taxes. When the legislature says they gave education billions in funding, those funds were only to back-fill the reduction in funding to school districts as a result of a reduction in local property taxes. That back-fill did not in any way increase what school districts receive in funding.

-

If we are “supposed” to be funded at $6,160 per student under the ADA funding and we will never have 100%, where is the rest of the money?

Any funds beyond ADA would simply remain with the state or be recaptured from the district by the state. Those funds, theoretically, could be used to provide funding for districts that are not as tax-wealthy; however, there is little accountability regarding how recapture (also known as “Robin Hood”) funds are used, and it likely that this has contributed to the state building up a nearly $50 billion budget surplus.

-

If my property taxes are so high, where are those funds going?

Districts only keep the portion of local property taxes allotted to them by the state. When property taxes increase, the excess above a district’s allotment is kept by the state for redistribution to other districts.

-

Why haven’t you been more open about the realities of the budget crisis?

Keller ISD is actually ahead of the curve and leaving ourselves a runway as we work through these budget issues. We are discussing the 2024-25 budget months before we would in a typical year. We have provided many learning opportunities for our community to stay up to date on these budget challenges, including two educational seminars, as well as a recent budget workshop. We don’t have to make all of these decisions yet, but we are being proactive in order to remain financially responsible and preserve our exceptional learning environment despite these challenges. You can keep track of budget updates by clicking here to visit our Budget Updates page, where we will post recent videos and the most up-to-date information.

-

Does the Keller ISD budget have to be approved by TEA?

No, the Texas Education Agency does not have to approve Keller ISD’s budget. TEA has guidelines and recommendations in place for school district budgets, but the authority to approve the budget rests with a district’s respective Board of Trustees.